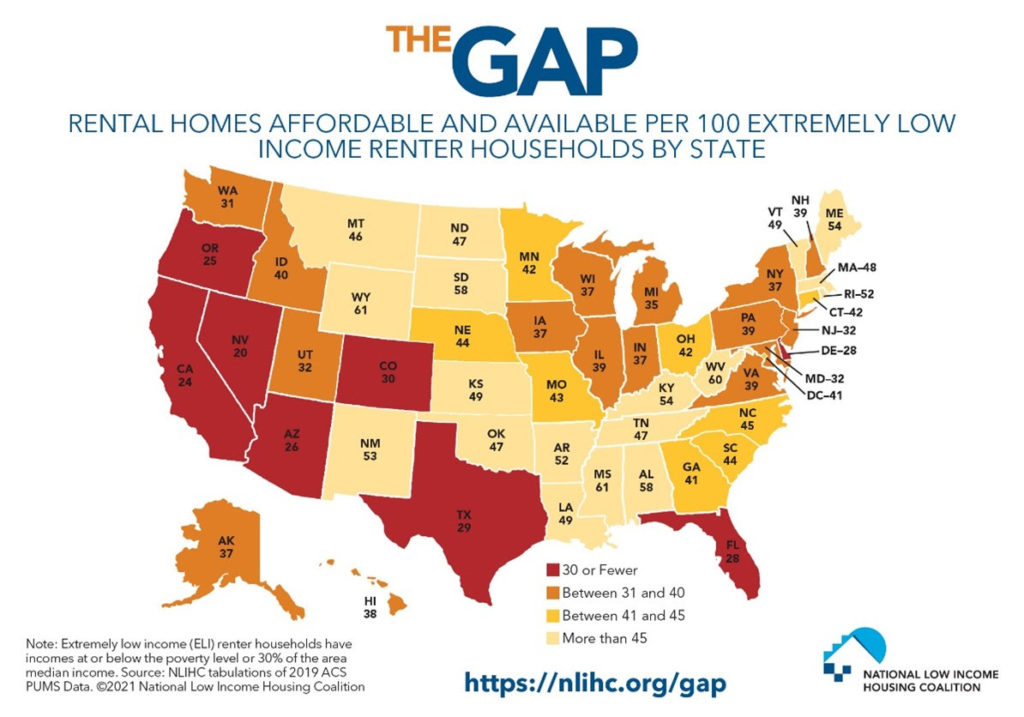

Earlier this month the National Low Income Housing Coalition released a report on the availability of affordable rental units in each state and 50 major metropolitan areas across the county. The report, entitled “The Gap: A Shortage of Affordable Rental Homes,” found that not a single state has an adequate supply of rental housing that is affordable for the lowest income renters.

Available rental units that are affordable to extremely low-income renters are in short supply, with as few as 20 units per every 100 families that need them in some states. In states with more accessible housing for low income renters, there were still only up to 61 available affordable units for every 100 extremely low-income families. Because this study only accounted for families with an address, these harrowing statistics do not even include the over 500,000 people experiencing homelessness in the United States or those families who are doubling up to stay housed.

In Louisiana specifically, there are 108 affordable homes for every 100 families at the average median income, but only 49 for every 100 extremely low-income families. This leaves over 80% of extremely low-income families rent burdened in the state.

The New Orleans metropolitan area has exceptionally alarming statistics. With 54,314 extremely low-income households, there are only 18,696 units available that are affordable to them. This means that there are just 34 affordable units available in the city for every 100 extremely low-income families. In New Orleans, nearly 80% of extremely low-income families are rent burdened and 74% are severely rent burdened. Of renters who earn 80-100% of the average median income, about 18% are rent burdened and only 4% are severely rent burdened.

Additionally, low-income renters are forced to compete with higher income families in the private housing market. While higher income families sometimes prefer to live in low-priced housing, extremely low income families have no other affordable options.

48% of extremely low-income renters are seniors or disabled individuals. Another 43% are either in the labor force, in school, or are single adult caregivers. Over 70% of extremely low-income renters in the United States are severely rent burdened, meaning that they pay over half of their monthly household income to housing costs alone. Black, Native American, Latinx, and Asian American renters are significantly more likely to be extremely low income than white non-Latinx renters and are also less likely to be homeowners due to systemic discrimination.

With many low-income families earning such low wages in the labor force that they can barely afford rental housing while working full time, the loss of hours and loss of jobs that many have experienced since the beginning of the pandemic creates rent debt many cannot pay and puts families at risk of eviction. An eviction record significantly decreases the number of rental units available to a family in the private market.

While affordable housing is always a necessity, during the current COVID-19 pandemic, it can be an immediate life or death issue. Lack of housing affordability for low income families can often lead to negative mental and physical health outcomes, decreased personal safety, and more limited funds available to spend on other necessary resources like food. During a pandemic, when staying home is the way to stay safe, and shutdowns are resulting in decreased income for many households, the gap in housing realistically available to low income renters is putting more families at risk of housing instability and exposure to a potentially deadly virus.

According to the findings in “The Gap,” the effective and immediate solution to this shortage of 7 million affordable rental homes is to increase capital investments, increase rental assistance programs, and expand the Housing Choice Voucher Program (previously known as Section 8) to be available to all income eligible households.

While politicians often like to talk about “the missing middle” or the necessity of focusing policy on the needs of renters making between 80-100% of the average median income, the data actually shows that renter households making less than 50% of the average median income are facing the most dire housing gap. We need to push our representatives to focus affordable housing policy on the lowest income households to prevent displacement and ease cost burdens on renters already living with the hardships of poverty.

To read the full report, click here: https://reports.nlihc.org/sites/default/files/gap/Gap-Report_2021.pdf

To visit the National Low Income Housing Coalition website, click here: https://nlihc.org/