The Fair Housing Act of 1968 prohibited discrimination in the rental, sale, and financing of a home based on race or national origin. Unfortunately, discriminatory practices and their legacies live on today throughout the United States. Redlining refers to a lending practice from the 1930s in which banks would deny families of color home loans and steer them away from predominantly white neighborhoods. Neighborhoods would be marked on a map based on how “desirable” they were. This desirability was largely based on the presence of people of color or immigrants in the area. Neighborhoods that were home to communities of color were marked red on the map to signify “hazardous.” Though redlining is now illegal, it still has a significant influence on neighborhood segregation, health outcomes, and life expectancy today. The influence of redlining on American neighborhoods is one of the major factors for the continued existence of a wide racial wealth gap.

Today, about 74% of white Americans own a home, compared to 44% of Black Americans. Not only do fewer Black Americans own homes, but the average value of their homes is much less than their white counterparts. A study by the real-estate website Zillow found that, “On average, a home located in an area that was given a ‘hazardous’ rating back in the 1930s is only worth 85% of the median value of a home in surrounding, non-redlined neighborhoods.” This reality is devastating to Black families’ ability to build generational wealth through homeownership.

While Latinx families still own homes at a considerably lower rate than the national average, they were the only demographic to see an increase in home ownership in each of the last five years. All of that is on the line, however, in the face of a global pandemic. It is also important to note that mortgage lending is often less accessible to Latinx families making it more common for those families to have to wait to purchase a home with cash. This puts lower income Latinx households at a severe disadvantage when it comes to homeownership and building equity.

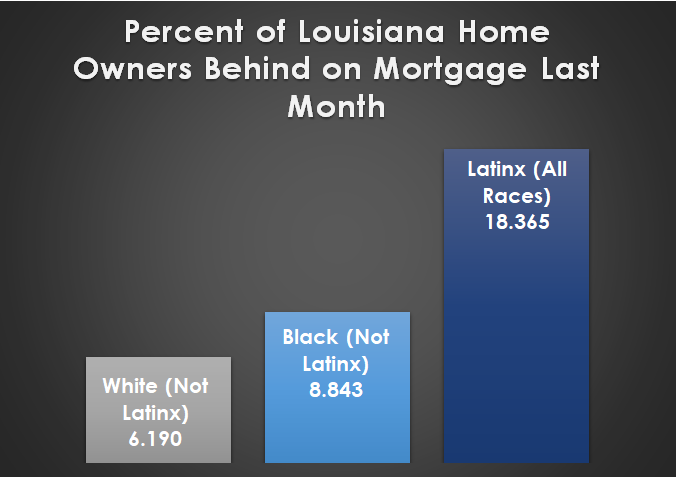

The COVID-19 pandemic is adding pressure to the future of homeownership for families of color and threatening to expand the homeownership gap. A Harvard University study found that 17 percent of Black homeowners were late on their mortgage payment and 7 percent deferred their payment. In contrast, 5 percent of white homeowners were late on their mortgage payment and 4 percent deferred their payment. This study also showed that Latinx individuals were more likely to be working lower wage jobs that are more vulnerable to layoffs and furloughs during the pandemic. In Louisiana, Latinx homeowners are currently more likely than any other demographic to be behind on their mortgage during the pandemic. Additionally, 44 percent of distressed white homeowners received a deferment on their mortgage payment compared to only 31 percent of non-white homeowners. After starting on unequal footing due to the lower valuing of homes owned by people of color, minority homeowners now have less home equity to use as a financial buffer during times of economic crisis.

Although the Covid-19 pandemic has negatively impacted most Americans, it has disproportionately affected Black and Latinx communities who are three times more likely to contract the virus compared to white Americans. Families of color have also been more likely to experience unemployment, housing insecurity, and to lack health insurance. In Louisiana, 70 percent of the people who have died of COVID-19 were Black despite only being 33 percent of the state population. This disproportionate death ratio can be easily traced to the health outcomes in previously redlined neighborhoods. With higher rates of pre-existing conditions, higher rates of pollution, and less access to adequate medical care, it is no surprise that Black and Latinx communities are facing more severe cases of COVID-19. The disproportionate mortality rates are the direct result of institutional racism.

This pandemic will inevitably lead to a decrease of homeownership across the country, but especially for people of color. This is not the first time a threat to homeownership has had a significantly smaller effect on white families. Many Black families are still trying to recover from the recession in 2008 when homes were foreclosed on in Black communities at twice the rate as in white communities. Unfortunately, this most recent disaster is likely to increase the homeownership and wealth gap between white families and families of color, continuing a trend that was perpetuated by redlining throughout American history, and leading to increasingly disparate life expectancies and health outcomes.

If you are worried you could lose your home, please reach out to our Homeownership Protection program today. You can reach us at (887)445-2100, (504)596-2100, or visit https://lafairhousing.org/homeowner-counseling.

You can help protect homeownership for all. The HEROES Act, passed by the U.S. House of Representatives, includes relief for homeowners, full unemployment benefits, funding for schools, and support for COVID-19 testing, the U.S. Postal Service, and other essential services, but it still needs to pass the Senate. Join us and